The latest aluminum awning windows design for your home in...

Read MoreΆρθρο: Μετά τις εμπορικές συνομιλίες Κίνας-ΗΠΑ: Αλουμινίου για τους πελάτες των ΗΠΑ

Μετά τις εμπορικές συνομιλίες Κίνας-ΗΠΑ: Αλουμινίου για τους πελάτες των ΗΠΑ

- omd

- Μάιος 17, 2025

- 1:19 μμ

Introduction

On May 14, 2025, the Joint Statement from the China-U.S. Geneva Trade Talks officially took effect. The U.S. reduced tariffs on Chinese goods from 145% to 30% and suspended 24% of tariffs for 90 days. This reduction in trade barriers presents new opportunities for the aluminum doors and windows industry. China’s export of aluminum doors and windows is expected to significantly reshape its trade relationship with the U.S.

1. Energy-Efficient Aluminum Doors and Windows: Policy Incentives and Market Demand

In the U.S., building energy use accounts for 40% of total energy consumption, and lighting systems make up 40% of that, according to the U.S. Department of Energy. California’s Title 24 energy standards and similar regulations are increasing demand for energy-efficient building upgrades. The recent tariff reduction makes Chinese energy-efficient aluminum doors and windows more affordable.

Key Features:

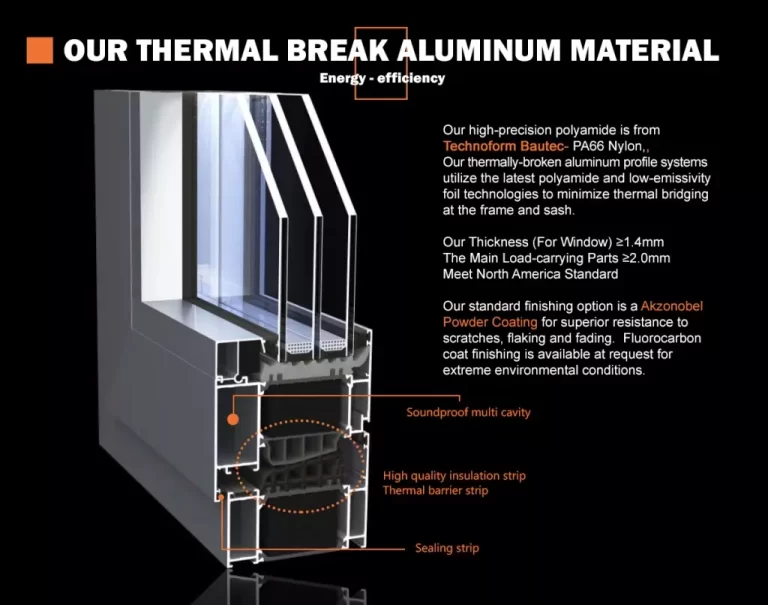

- Low Thermal Conductivity Profiles: Using thermal break aluminum and double or triple-glazed windows, these doors and windows offer over 30% better insulation.

- Integrated Photovoltaic Design: Window systems with solar panels meet U.S. green building certifications like LEED.

- Market Opportunity: After the tariff reduction, Chinese products are 15%-20% cheaper than U.S. alternatives.

2. Smart Aluminum Doors and Windows: Competing in the High-End Market

In 2024, the U.S. smart home market grew by 12%, with projections reaching $99.4 billion by 2032, growing at an annual rate of 16.9%. Eased restrictions on semiconductor supply chains between China and the U.S. now make it easier for Chinese smart door and window components to enter the high-end market.

Core Features:

- IoT Control: Compatible with voice assistants like Alexa and Google Home, allowing remote temperature control and security monitoring.

- Self-Regulating Ventilation: Built-in sensors monitor air quality and automatically adjust window openings.

- Supply Chain Advantage: China’s Pearl River Delta and Yangtze River Delta regions have smart hardware clusters that reduce delivery times by 30%-50% compared to Europe and the U.S.

3. Cost-Effective Standard Aluminum Doors and Windows: Meeting “Stock Replenishment” Demand

Though the U.S. still has a 10% “safeguard” tariff, the reduction from 145% to 30% has lowered costs and boosted demand for mid-to-low-end products.

Key Categories:

- Standard Sliding Doors and Windows: Ideal for bulk purchases in apartments and commercial real estate, 25%-35% cheaper than U.S. products.

- Economical Casement Windows: Known for durability and ease of installation, these cater to the DIY market.

- Procurement Strategy: U.S. distributors prefer a “small batch, quick return” model (500-1,000 units per order) to test the market before committing to larger orders.

4. Customized High-End Aluminum Doors and Windows: Competing in Niche Markets

The growing demand for unique designs in high-end residential and commercial projects, combined with China’s flexible manufacturing, is driving the growth of customized aluminum doors and windows.

Design Trends:

- Large-Scale Scenic Doors and Windows: Folding and lift-and-slide doors wider than 3 meters, ideal for villas and resorts.

- Artistic Surface Treatments: Techniques like wood grain transfer and anodized coloring to meet personalized design needs.

- Service Advantage: Leading Chinese manufacturers have digitized the process, reducing lead times for customization from 8 weeks to 4 weeks.

Procurement Strategy Recommendations Amid Supply Chain Restructuring

- Seize the 90-Day Tariff Window: U.S. clients are rushing to place orders to catch up on backlogged shipments. Independent platforms should update inventory data in real time and label products as “90-Day Tariff Protection Special Offer” to encourage fast decisions.

- Enhance Compliance Certifications: U.S. buyers value certifications like NAFS (North American Fenestration Standard) and ENERGY STAR. Display these certifications prominently on product pages to build trust.

- Establish Regional Warehouses: Setting up warehouses in the U.S. (e.g., Los Angeles or Houston) for “7-day delivery” can help mitigate long-term tariff risks.

Conclusion: Moving from “Price Wars” to “Value Wars”

The recent tariff changes offer more than just a short-term boost in orders. They offer a great opportunity for Chinese aluminum door and window companies to move from competing on price to offering high-value products. By providing energy-efficient, smart, and customized solutions, and using China’s complete industrial chain and fast response capabilities, independent platform operators can better meet U.S. client needs and gain a competitive edge in the new phase of China-U.S. trade relations.

Μετά τις εμπορικές συνομιλίες Κίνας-ΗΠΑ: Αλουμινίου για τους πελάτες των ΗΠΑ

After the China-U.S. Trade Talks: Focus on Aluminum Doors and...

Read MoreΟ Πάουελ προειδοποιεί για τους κινδύνους από την επιβολή δασμών στις ΗΠΑ. Μπορούν οι κινεζικές συρόμενες πόρτες αλουμινίου να καταλάβουν ακόμα τις αγορές των ΗΠΑ και της Ευρώπης το 2025;

Introduction On May 8, 2025, the United States and the...

Read MoreΕπίδραση της αεροπορικής επιδρομής της Ινδίας στο Πακιστάν και το ελεγχόμενο από το Πακιστάν Κασμίρ στις εξαγωγές παραθύρων και πορτών αλουμινίου της Κίνας

1. Background Overview: Escalation of India-Pakistan Conflict and US-China Trade...

Read More